Johnson & Johnson 2023: A new era: achievement, evolution, and rebranding

J&J is heading into the remainder of 2023 with a new look and a revised outlook.

By Maria Fontanazza • [email protected]

One Johnson & Johnson Plaza

New Brunswick, NJ 08933

732-524-0400 • jnj.com

| Financial Performance | ||||

| 2022 | 2021 | 1H 2023 | 1H 2022 | |

| Revenue | $94,943 | $93,775 | $42,413 | $40,055 |

| Net income | $17,941 | $20,878 | $4,885 | $8,833 |

| Diluted EPS | $6.73 | $7.81 | $1.86 | $7.81 |

| R&D Expense | $14,603 | $14,714 | $7,392 | $7,165 |

|

All figures are in millions of dollars, except EPS. *Recast financial results to reflect the continuing company operations without Kenvue Inc. (as of August 30, 2023) |

||||

Best-selling Rx products

All sales are in millions of dollars.

2022 sales

- Stelara $9,723

- Darzalex $7,977

- Invega Sustenna/ Xeplion/Invega Trinza/Trevicta $4,140

- Imbruvica $3,784

- Tremfya $2,668

- Xarelto $2,473

- Remicade $2,343

- Simponi/Simponi Aria $2,184

- COVID-19 Vaccine $2,179

- Prevista/Prezcobix/Rezolsta/Symtuza $1,943

- Erleada $1,881 $

- Opsumit $1,783 $

- Zytiga/ abiraterone acetate $1,770

- Uptravi $1,322

- Edurant/rilpivirine $1,008

- Concerta/methylphenidate $644

- Risperdal Consta $485

- Invokana/Invokamet $448

1H 2023 sales

- Stelara $5,241

- Darzalex $4,695

- Invega Sustenna/ Xeplion/Invega Trinza/Trevicta $2,075

- Imbruvica $1,668

- Tremfya $1,346

- Xarelto $1,215

- Erleada $1,109

- Simponi/Simponi Aria $1,066

- COVID-19 Vaccine $1,032

- Prevista/Prezcobix/Rezolsta/Symtuza $968

- Remicade $949

- Opsumit $947

- Uptravi $761

- Edurant/rilpivirine $546

- Zytiga/abiraterone acetate $472

- Concerta/methylphenidate $414

- Spravato $300

- Carvykti $189

Outcomes Creativity Index Score: 11

- Manny Awards — N/A

- Cannes Lions — 2

- Clio Health — N/A

- Creative Floor Awards — 4

- LIA: Pharma/Health & Wellness – N/A

- MM+M Awards — 5

- One Show — N/A

Less than a month after finalizing the separation of Kenvue Inc., Johnson & Johnson announced a complete rebrand that involves phasing out the name Janssen, its pharmaceutical segment, which has been a part of the J&J family for more than 60 years. The company’s pharmaceuticals business has been renamed Johnson & Johnson Innovative Medicine, focusing on oncology, immunology, neuroscience, cardiovascular, pulmonary hypertension, and retina, while J&J’s medical technology segment will be known as Johnson & Johnson MedTech and will continue to address surgery, orthopedics, vision, and interventional solutions.

“The announcement marks the next era for Johnson & Johnson, which is leveraging its expertise in innovative medicine and medical technology to prevent, treat and cure complex diseases and introduce solutions that are smarter, less invasive, and more personalized,” the company stated in its news about the rebrand.

J&J Chairman and CEO Joaquin Duato is enthusiastic about the establishment of two clear segments, the names of which intend to more closely connect to the Johnson & Johnson brand. “Our exclusive focus on Innovative Medicine and MedTech solutions enables us to innovate across the full spectrum of health care in ways no other company can,” Duato said. “Uniting our diverse businesses under an updated Johnson & Johnson brand reflects our unique ability to reimagine health care through transformative innovation, while staying true to Our Credo values and the level of care that patients and doctors expect of us.” J&J also unveiled a new, modern logo to mark its “next chapter.”

Johnson & Johnson unveiled its new brand identity in September. The intent is to more closely connect the company’s two distinct segments to the Johnson & Johnson brand.

Last year Duato took the helm as CEO of Johnson & Johnson. Outgoing CEO Alex Gorsky had remained on board as executive chairman until stepping down in November 2022. The board of directors elected Duato as chairman, and he assumed this role in January 2023.

“Joaquin’s appointment to the additional role of Chairman reflects his tremendous 30-year track record at Johnson & Johnson, as well as the board’s thoughtful and engaged approach to succession planning,” said Anne Mulcahy, independent lead director. “During Joaquin’s career with the company, the board has witnessed firsthand his ability to effectively lead, collaborate, and create value for all our stakeholders. We have the utmost confidence that he will continue to be an excellent steward of the business and look forward to working closely with him in this next chapter.”

Another notable leadership appointment was that of John Reed, M.D., Ph.D., to the company’s executive committee as executive VP of pharmaceuticals, R&D. Reed brings 35 years of experience in biomedical research leadership, having previously served as executive VP, global head of research and development at Sanofi.

Financial & product performance

J&J has a strong focus on building its digital capabilities: artificial intelligence, data science, and intelligent automation, which it believes will ignite future innovation. The company touts its accomplishments amidst the “high inflation, geopolitical tension, and continued supply chain disruption” faced by every industry.

As of July 2023, J&J had 30 products listed in its key events pipeline and 98 indications listed for its pharmaceuticals in development.

Eighteen of J&J’s prescription medicines are on the World Health Organization’s list of essential medicines. More than a dozen of J&J’s products ranked on the Med Ad News Top 200 Prescription Medicines by 2022 Global Sales: Stelara (ustekinumab), Darzalex (daratumumab), Xarelto (rivaroxaban), Imbruvica (ibrutinib), Invega Sustenna/Xeplion (paliperidone palmitate) and Invega Trinza/Invega Trevicta (paliperidone palmitate)/, Simponi and Simponi Aria (golimumab), Remicade (infliximab), Tremfya (guselkumab), the Janssen COVID-19 vaccine, Prezista (darunavir), Prezcobix/Rezolsta (darunavir/cobicistat) and Symtuza, Erleada (apalutamide), Opsumit (macitentan), Zytiga/abiraterone acetate, Uptravi (selexipag), and Edurant/rilprivirine.

Last year’s worldwide sales increased 1.3 percent to $94.9 billion as compared to an increase of 13.6 percent in 2021. Pharmaceutical segment sales increased 1.7 percent over 2021 to reach $52.6 billion. This included 6.7 percent operational growth and a negative currency impact of 5 percent. U.S. sales increased 2.3 percent to $28.6 billion, while international sales increased 1 percent to $24 billion. Adjusted net earnings were $27 billion and adjusted diluted net earnings per share were $10.15, representing increases of 3.2 percent and 3.6 percent respectively, versus 2021. On an operational basis, adjusted diluted net earnings per share increased by 9.2 percent.

Immunology products contributed $16.9 billion in sales for 2022, increasing 1.1 percent over 2021. Operational growth was boosted by Stelara in Crohn’s disease and ulcerative colitis, and Tremfya in psoriasis and psoriatic arthritis. Although Stelara brought in $6.4 billion in sales last year, its patent expired in September, which J&J anticipates will have a negative impact on sales. Remicade also experienced lower sales due to the introduction of competitive biosimilars in both the United States as well as ex-U.S.

2022 sales of oncology products enjoyed 9.9 percent growth, hitting $16 billion, thanks to growth of Darzalex in all regions and uptake of the subcutaneous formulation, and the global launch of Erleada. Declining sales were experienced by Imbruvica due to competitive pressures and market suppression, and Zytiga as a result of loss of exclusivity in the European Union.

Last year’s infectious disease product sales fell 6.5 percent to $5.4 billion, but operational growth was boosted by OUS COVID-19 vaccine sales. Prezista and Prezcobix/Rezolsta also experienced lower sales due to more competition and loss of exclusivity of Prezista OUS. Sales of neuroscience products also fell 1.4 percent over 2021 to $6.9 billion. The operational sales growth of Invega Sustenna/Xeplion and Invega Trinza/Trevicta from new patient starts and persistence, along the launch of Invega Hafyera, was offset by negative currency impacts and lower sales of Risperdal Consta.

Pulmonary hypertension products sales for 2022 fell 1 percent to $3.4 billion, but Opsumit and Uptravi continued to show growth. Within cardiovascular, metabolism, and other pharma products, 2022 sales declined 5.9 percent to $3.9 billion. J&J attributed the operational decline to lower sales of Invokana/Invokamet (canagliflozin) as a result of share erosion and biosimilar competitors to Procrit/Eprex (epoetin alfa).

“We invested nearly $15 billion in R&D, deployed more than $17 billion toward acquisitions, increased our dividend for the 60th consecutive year, and returned capital to shareholders through our share repurchase program. Our total shareholder return (TSR) for 2022 outperformed both our Competitor Composite and the S&P 500, contributing to our TSR of nearly 13 percent compounded annual growth rate over the last 10 years. This significant value creation was made possible by both our long-term strategic focus and outstanding execution from teams in all three segments of our business,” said Duato. “Last year’s acquisitions and divestitures had a net negative impact of 0.1 percent on the operational sales growth of J&J’s worldwide pharmaceutical segment. In addition, adjustments to previous sales reserve estimates were approximately $0.1 billion and $0.7 billion in fiscal years 2022 and 2021, respectively.”

For the first half of 2023, J&J’s pharmaceutical business brought in $27.1 billion, with adjusted operational growth of 5.6 percent. Growth was driven by Darzalex, Erleada, and Carvykti (ciltacabtagene autoleucel) in oncology; Stelara and Tremfya in immunology; Uptravi and Opsumit in pulmonary hypertension; and Spravato (esketamine) in neuroscience. Growth was partially offset by Zytiga and Imbruvica; the COVID-19 Vaccine (Ad26.COV2.S) in infectious diseases; and Remicade in immunology.

As previously noted, J&J finalized the separation of its consumer health business Kenvue Inc. in late August. In accordance with the exchange offer, J&J accepted 190,955,436 shares of Johnson & Johnson common stock in exchange for 1,533,830,450 shares of Kenvue common stock. On August 30 the company also released updates to its financial results and earnings guidance to reflect the continuing operations of Johnson & Johnson, without the consumer health business. Moving forward, J&J will present its consumer health business as discontinued operations.

Q2 2023 worldwide pharmaceutical sales were as follows: immunology $4.5 billion, oncology $4.4 billion, neuroscience $1.8 billion, infectious diseases $1.1 billion, pulmonary hypertension $972 million, and cardiovascular/metabolism/other $950 million. “Our robust performance in the second quarter and first half of 2023 is a testament to the hard work and commitment of our colleagues around the world,” said Duato. “We are entering the back half of the year from a position of strength with numerous catalysts, including becoming a two-sector company focused on Pharmaceutical and MedTech innovation.”

Looking ahead, J&J expects increased 2023 reported sales growth of 7-8 percent, operational sales growth of 7.5-8.5 percent, and adjusted operational sales growth of 6.2-7.2 percent (these figures exclude the COVID-19 Vaccine). The company expects 2023 adjusted reported EPS of $10.00 – $10.10, reflecting increased growth of 12.5 percent at the mid-point, and adjusted operational EPS of $9.90 – $10.00, reflecting increased growth of 11.5 percent at the mid-point. J&J reduced outstanding share count by about 191 million; 2023 guidance reflects only a partial-year benefit of approximately 73.5 million shares or $0.28 benefit to EPS. In addition, the company secured $13.2 billion in cash proceeds from the Kenvue debt offering and initial public offering and maintains 9.5 percent of equity stake in Kenvue. It maintains its quarterly dividend of $1.19 per share.

Three of J&J’s medicines – Xarelto, Imbruvica, and Stelara – made the Centers for Medicare & Medicaid Services’ (CMS) first list of drugs covered under Medicare Part D selected for price negotiation. CMS will publish the agreed-upon negotiated prices for the drugs by September 1, 2024, and the prices will go into effect on January 1, 2026. In July J&J announced that it filed a lawsuit against CMS to block the drug price negotiations. “The IRA [Inflation Reduction Act] breaks the agreement at the heart of the patent and regulatory laws: when companies invest and succeed at developing innovative new treatments, they are awarded time-limited and constitutionally protected rights in their innovation,” Johnson & Johnson said in a company statement. “With the implementation of the IRA, the government is forcing Janssen to provide its innovative, patented medicines on pricing terms that by law must be significantly below market prices. This would upend the current self-sustaining cycle of pharmaceutical innovation that provides patients with access to pioneering treatments, and directly impacts the creation of generic medicines that account for 90 percent of prescriptions filled in the U.S. If manufacturers do not ‘agree’ to the government-dictated terms of the IRA, they face massive penalties up to 1900 percent of a selected drug’s daily sales or are forced to withdraw all of their products from both Medicare and Medicaid – potentially depriving nearly 40 percent of U.S. patients of needed medicines.”

Product approvals & pipeline updates

As of July 2023, J&J had 30 products listed in its key events pipeline for potential approvals or planned submissions in the United States and/or European Union, potential clinical data developments, and Phase II trials, and 98 indications listed for its pharmaceuticals in development. The following are just a few highlights from J&J’s 2023 product approvals and pipeline developments.

J&J says the approval of Akeega highlights the value of precision medicine and the importance of genetic testing in patients with metastatic castration-resistant prostate cancer to ensure the right patients receive the right treatment.

In August FDA approved Akeega (niraparib and abiraterone acetate). The first-and-only dual action tablet (DAT) combining a PARP inhibitor with abiraterone acetate, Akeega is given with prednisone, for the treatment of adult patients with deleterious or suspected deleterious BRCA-positive metastatic castration-resistant prostate cancer (mCRPC), as detected by an FDA-approved test. In April Janssen received the first worldwide approval for Akeega with the European Commission granting marketing authorization for the drug. The DAT is authorized to treat adult patients with mCRPC and BRCA1/2 mutations (germline and/or somatic) in whom chemotherapy is not clinically indicated. In Europe, prostate cancer is the most common cancer in males. It is also the sixth-highest cause of cancer-related death worldwide. According to Peter Lebowitz, M.D., Ph.D., global therapeutic area head, oncology at Janssen Research & Development, LLC, the European milestone “highlights the value of precision medicine and the importance of genetic testing in patients with mCRPC to ensure the right patients receive the right treatment.”

In late August a supplemental New Drug Application was submitted to FDA for Balversa (erdafitinib), a kinase inhibitor, for treating adults with locally advanced or metastatic urothelial carcinoma (mUC) that has susceptible fibroblast growth factor receptor (FGFR)3 genetic alterations, and progressed during or following at least one line of a programmed death receptor-1 (PD-1) or programmed death-ligand 1 (PD-L1) inhibitor in the locally advanced or metastatic setting or within 12 months of neoadjuvant or adjuvant therapy. Also known as transitional cell carcinoma, urothelial carcinoma is the most common form of bladder cancer.

“Belversa continues to generate promising clinical findings for patients with FGFR-altered metastatic urothelial cancer, who often face poor disease outcomes,” said Peter Lebowitz, M.D., Ph.D., global therapeutic area head, oncology, Janssen Research & Development. “Through the ongoing development of this targeted therapy, we are committed to transforming bladder cancer treatment to positively impact the lives of patients.” In early September, Janssen submitted a marketing authorization application to the European Medicines Agency for the approval of erdafitinib for treating patients with locally advanced or mUC with susceptible FGFR alterations.

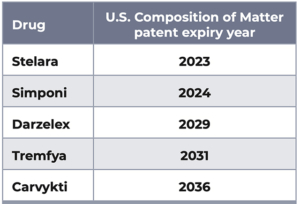

The table displays information regarding the expiry year of the U.S. composition of matter patent owned by or licensed to Janssen with respect to each of the referenced products. This table is not comprehensive as additional patents relevant to these products might describe additional active ingredients, formulations, dosing regimens, medical prophylactic or treatment methods, devices used in combination with products, or production methods. Information as of June 1, 2023.

Janssen submitted a supplemental Biologics License Application (sBLA) to the FDA for a new indication for Carvykti to treat adults with relapsed or refractory multiple myeloma who have received at least one prior line of therapy including a proteasome inhibitor, an immunomodulatory agent, and are refractory to lenalidomide. Supporting data includes the CARTITUDE-4 study (NCT04181827), the first randomized Phase III study evaluating the efficacy and safety of Carvykti versus pomalidomide, bortezomib, and dexamethasone or daratumumab, pomalidomide, and dexamethasone in treating patients with relapsed or lenalidomide-refractory multiple myeloma who received one to three prior lines of therapy.

In January Janssen stated that the CARTITUDE-4 study met its primary endpoint of significant improvement in progression-free survival at the first pre-specified interim analysis, so the Independent Data Monitoring Committee recommended unblinding the study. The secondary endpoints were safety, overall survival, minimal residual disease negative rate, and overall response rate.

In August an sBLA was also submitted to the FDA for the approval of Rybrevant (amivantamab-vmjw) in combination with chemotherapy (carboplatin-pemetrexed) for the first-line treatment of patients with locally advanced or metastatic NSCLC with epidermal growth factor receptor (EGFR) exon 20 insertion mutations. The agency is reviewing the sBLA via the Real-Time Oncology Review program. The sBLA is supported by data from the Phase III Papillon clinical trial. In July Janssen announced that the study met its primary endpoint with a statistically significant and clinically meaningful improvement in PFS (as measured by BICR) in patients receiving Rybrevant plus chemotherapy versus chemotherapy alone. Following Breakthrough Therapy Designation from the FDA in 2020, Rybrevant received accelerated approval in 2021 as the first fully-human, bispecific antibody for treating patients with NSCLC with EGFR exon 20 insertion mutations.

Rybrevant is in several additional clinical trials in NSCLC, including the Phase III Mariposa study (used in combination with Lazertinib); Phase III Mariposa-2 study (used in combination with lazertinib versus osimertinib and versus lazertinib alone); Phase I Chrysalis study; the Phase I/Ib Chrysalis-2 study (in combination with lazertinib and lazertinib as a monotherapy); Phase I Paloma study; Phase II Paloma-2 study; Phase III Paloma-3 study; Phase I/II Metalmark study (and capmatinib combination therapy); Phase I/II PolyDamas study (with cetrelimab combination therapy); and Phase II SKIPPirr study (in combination with Lazertinib).

Announced in September, follow-up results from the Phase I/Ib Chrysalis-2 study, which evaluated the safety and tolerability of the combination of Rybrevant with Lazertinib plus platinum-based chemotherapy (carboplatin and pemetrexed) in patients with relapsed/refractory MSCLC showed durable progression-free survival.

“The strong anti-tumor activity of RYBREVANT in EGFR-driven cancers reinforces the utility of this targeted, bispecific therapy in patients whose tumors are resistant,” said Kiran Patel, M.D., vice president, clinical development, solid tumors, Janssen Research & Development. “These results provide important insights into the treatment of patients with advanced non-small cell lung cancer with EGFR-mutated disease who have progressed on the current standard of care. We look forward to upcoming late-stage Phase III study readouts.”

One final notable approval in oncology was Talvey (talquetamab-tgvs) receiving a nod from FDA for the treatment of adult patients with relapsed or refractory multiple myeloma who have received at least four prior lines of therapy, including a proteasome inhibitor, an immunomodulatory agent, and an anti-CD38 antibody. Talvey is a bispecific T-cell engaging antibody that binds to the CD3 receptor on the surface of T cells and G protein-coupled receptor class C group 5 member D (GPRC5D) expressed on the surface of multiple myeloma cells, non-malignant plasma cells and healthy tissue such as epithelial cells in 2 keratinized tissues of the skin and tongue. Granted in August, the agency’s accelerated approval is based on response rate and durability of response, and continued approval for the above indication is contingent upon verification and description of clinical benefit in confirmatory trial(s).

The partnership with Cellular Biomedicine Group boosts J&J’s portfolio in B-cell malignancies and strengthens its more than two-decade history in hematology, while enhancing its commitment to accelerate development, manufacturing, and commercialization capabilities to deliver best-in-class cell therapies.

In May Janssen Biotech entered into a license agreement with Cellular Biomedicine Group Inc. to develop, manufacture, and commercialize next-generation chimeric antigen receptor (CAR) T-cell therapies for the treatment of B-cell lymphoma. Under the agreement terms, Cellular Biomedicine will give Janssen a worldwide license to develop and commercialize the CAR-T assets, except in Greater China. The two companies will negotiate an option for Janssen to commercialize the products in the China territory. Janssen made an upfront payment of $245 million, which was accounted for as a Q2 2023 R&D expense.

Also in May FDA granted a fast track designation for all three indications for milvexian, an investigational oral factor XIa (FXIa) inhibitor (being developed in collaboration with Bristol Myers Squibb). The three indications are under evaluation in the Phase III Librexia development program (Librexia STROKE, Librexia ACS, and Librexia AF) for ischemic stroke, acute coronary syndrome, and atrial fibrillation. “For milvexian to receive Fast Track Designation from the FDA for all three indications demonstrates the enormous unmet need that still exists for the treatment of thrombotic events, like heart attack and stroke,” said James F. List, M.D., Ph.D., global therapeutic area head at Janssen Research & Development. “We are now focused on enrolling patients to these trials with urgency, bringing us one step closer to potentially improving outcomes in a wide range of patients with thrombotic diseases.”

In late spring Janssen submitted a New Drug Application to FDA for approval of macitentan and tadalafil as an investigational single tablet combination therapy for long-term treatment of patients with pulmonary arterial hypertension (PAH). J&J states it is the first and only single tablet combination therapy application to be submitted for review in the United States for PAH. The application is based on positive data from the Phase III A DUE study, which met its primary endpoint and demonstrated that M/T STCT significantly improved pulmonary hemodynamics versus macitentan and tadalafil monotherapies in this PAH patient population. PAH is a rare, progressive, and life-threatening blood vessel disorder characterized by the constriction of small pulmonary arteries and elevated blood pressure in the pulmonary circulation that eventually leads to right heart failure.

Tremfya has been in Phase III trials for ulcerative colitis monotherapy and Crohn’s disease. The Phase III Quasar study for inflammatory bowel disease showed positive induction results in patients with moderately to severely active ulcerative colitis. The data revealed statistically significant and clinically meaningful improvements across symptomatic and histo-endoscopic outcome measures. “Results from the Quasar study offer insights into the potential utility of Tremfya for people living with this lifelong chronic condition and reinforce the known safety profile of TREMFYA observed in approved indications,” said Kavitha Goyal, M.D., Head of Global Medical Affairs, Gastroenterology, Janssen Global Services. “Janssen continues to investigate IL-23 pathway science with Tremfya for treatment of complex immune-mediated diseases like ulcerative colitis, so that healthcare providers can have a range of treatment options that best fit patients’ needs and can bring them closer to the goal of remission.”

Tremfya has also been under investigation for use in treating moderate-to-severe plaque psoriasis. Janssen released data earlier this year demonstrating that initiation of the drug was associated with greater treatment persistence compared to secukinumab or ixekizumab in bio-naïve and bio-experienced patients living with moderate-to-severe plaque psoriasis (PsO), based on pairwise analyses of real-world data. Post-hoc analysis of the Phase III Voyage 2 results showed durable clinical efficacy, itch relief, and improvement in the quality of live in patients who have scalp PsO. “Up to 80 percent of people living with PsO have scalp involvement, and it significantly impacts quality of life,” said Lloyd Miller, M.D., Ph.D., vice president, immunodermatology disease area stronghold, Janssen Research & Development. “These results continue to show the important role TREMFYA plays in the management of moderate to severe plaque PsO, including difficult-to-treat areas such as the scalp.”

Health for humanity

In June Johnson & Johnson released its “Health for Humanity Report” and the “We All Belong: 2022 Diversity, Equity and Inclusion (DEI) Impact Review”. One of the goals of the reports was to drive home the fact that the company takes its environmental, social, and governance strategy seriously and to also highlight its progress in advancing sustainable social, environmental, and economic change.

Last year, for the fifth year in a row, J&J received an A-list rating from non-profit CDP (Carbon Disclosure Project), which is considered the “gold standard” for environmental reporting. Johnson & Johnson also made a $14.6 billion R&D investment across its businesses and integrated capabilities related to how it operates. In addition, the company reached its Health for Humanity goal of achieving 35 percent ethnic and racial diversity in U.S. management positions.