Gilead beats Q2 Wall Street estimates on strong HIV, cancer, liver disease sales

Gilead beats Q2 Wall Street estimates on strong HIV, cancer, liver disease sales

Gilead Sciences delivered strong performance in the second quarter of 2024 with total revenue beating analyst expectations, driven by robust sales of its HIV and liver disease products, the company reported Thursday.

The company generated $6.95 billion in Q2 revenue, representing 6% year-over-year growth when excluding its COVID-19 antiviral Veklury (remdesivir). Product sales accounted for the bulk of Gilead’s revenue at more than $6.91 billion, beating the Wall Street consensus estimate of nearly $6.73 billion. On a per-share basis, the company’s non-GAAP diluted earnings were $2.01—analysts expected a Q2 diluted EPS of $1.61.

BMO Capital Markets analyst Evan Seigerman in an investor note called Gilead’s Q2 performance “stable,” which he attributed to “stable HIV, oncology, and liver disease revenues.” Gilead also demonstrated “better-than-expected” expense management, Seigerman wrote.

The once-daily HIV antiretroviral therapy Biktarvy (bictegravir/emtricitabine/tenofovir alafenamide) was Gilead’s stand-out asset in the quarter, surging 8% to bring in $3.23 billion worldwide. Biktarvy beat the analyst consensus, which pegged its Q2 sales at $3.22 billion.

Overall, the pharma’s HIV franchise also performed well in the quarter, growing 3% year-over-year to bring in $4.75 billion, falling broadly in line with Wall Street’s estimated $4.77 billion.

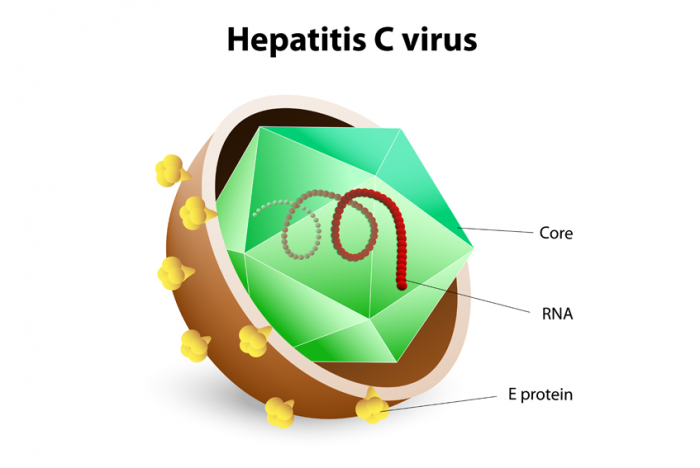

Gilead’s liver disease portfolio “showed some noted strength” in Q2, jumping 17% to bring in $832 million, according to Seigerman. The company is likely to see even greater growth in the hepatology space pending the potential approval of its investigational PPARδ agonist seladelpar, which is currently under regulatory review for the treatment of primary biliary cholangitis.

Reuters

Reuters