Company of the year 2023: Novo Nordisk – Riding the semaglutide wave

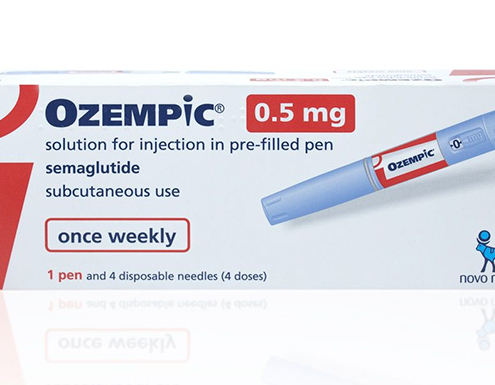

For Novo Nordisk, Ozempic is the game changer that has propelled the company to new heights, but mastering the supplies of its semaglutide drugs, especially Wegovy, is the current challenge.

By Christiane Truelove • [email protected]

Novo Nordisk

Novo Allé, 2880 Bagsværd, Denmark

+45 4444 8888 • novonordisk.com

| Financial Performance | ||||

| 2022 | 2021 | 1H 2023 | 1H 2022 | |

| Revenue | $24,998 | $19,891 | $15,210 | $11,767 |

| Net income | $7,844 | $6,747 | $5,544 | $3,889 |

| Diluted EPS | $3.45 | $2.93 | $2.46 | $1.71 |

| R&D Expense | $3,397 | $2,551 | $1,957 | $1,459 |

|

All figures are in millions of dollars, except EPS and were translated using the Federal Reserve Board’s average rate of exchange in 2022: DKK 7.0786. |

||||

Best-selling products

All figures are in millions of dollars, except EPS and were translated using the Federal Reserve Board’s average rate of exchange in 2022: DKK 7.0786.

2022 sales

- Ozempic $8,440

- NovoRapid $2,209

- Victoza $1,741

- Rybelsus $1,596

- Saxenda $1,508

- Tresiba $1,321

- NovoSeven $1,174

- NovoMix $1,008

- Wegovy $874

- Levemir $646

1H 2023 sales

- Ozempic $5,897

- Wegovy $1,706

- Rybelsus $1,179

- NovoRapid $994

- Saxenda $857

- Victoza $657

- Tresiba $555

- NovoSeven $550

- NovoMix $462

- Levemir $272

Outcomes Creativity Index Score: 20

- Manny Awards — 2

- Cannes Lions — 2

- Clio Health — 5

- Creative Floor Awards — 10

- LIA: Pharma/Health & Wellness – N/A

- MM+M Awards — 1

- One Show — N/A

For Novo Nordisk, the company’s present and future are mostly tied to the performance of semaglutide.

In 2023, Med Ad News’ company of the year is celebrating its centenary, and that event is “a major milestone in the evolution of our company and underlines the longevity and value of our distinct purpose,” says President and CEO Lars Fruergaard Jørgensen and Helge Lund, chair of the board of directors.

According to these executives, “At a time of societal debate about purpose versus profit, Novo Nordisk shows how the two can go hand-in-hand. The development of our life-changing treatments creates financial rewards that are reinvested in further research and development, a model that we will continue to apply as we build a sustainable business for the decades to come.”

Novo Nordisk in 2022 saw continued strong growth in its North America and international operations and therapy areas, driven by exceptional demand for its market-leading GLP-1 therapies. “In turn, this increase in demand led to further market share,” Jørgensen and Lund state.

The year also marked higher than expected demand and capacity limitations at some of its manufacturing sites, which resulted in shortages of its semaglutide-based products, particularly the diabetes drug Ozempic, the obesity drug Wegovy, and the diabetes drug Rybelsus.

According to executives, the company invested around DKK 12.7 billion ($1.79 billion) in 2022 alone to expand capacity while operating global manufacturing facilities 24 hours a day, seven days a week. “Like many other large companies, we are restructuring our supply chains to increase resilience in a volatile world.”

In June 2023, the company announced plans to invest DKK 15.9 billion ($2.25 billion) this year to expand an existing active pharmaceutical ingredient (API) production facility in Denmark for the future portfolio within serious chronic diseases.

Executives say the investment in Hillerød, Denmark, will create additional production capacity and increase Novo Nordisk’s ability to meet future market demands and be a key enabler for the company to develop its future clinical late-phase product portfolio. The new facility – which will be approximately 65,000 square meters – will be designed as a multi-product facility, with maximum flexibility to accommodate new processes and displaying state-of-the-art technology and working environment.

“As a future-proof and cost-effective facility, the construction will focus on delivering the highest quality to patients worldwide in an efficient and environmentally sustainable way,” executives say. “This will be done by designing optimal and compact process flows allowing a substantial reduction of water and energy consumption.” Construction is under way and the facility is expected to start producing API by early 2029.

Wegovy’s runaway success

Despite difficulty meeting demand for Wegovy, sales were $874 million in 2022 and have already surpassed $1 billion in the first half of 2023.

Wegovy, and its weight-loss promise, has propelled Novo Nordisk into the headlines. The company expects more than DKK 25 billion ($3.5 billion) in obesity product sales by 2025. This positivity comes even as Novo Nordisk struggled last year to meet demand, due to its contract manufacturer responsible for filling syringes for the drug failing an FDA inspection at the end of 2021.

“It is becoming clear that the efficacy of Wegovy has changed perceptions around obesity treatment, both among clinicians and patients – a fact reflected in the higher than expected demand for the product in the U.S.,” executives say. “Encouragingly, the availability of anti-obesity medication is improving around the world, with around 80 percent of commercial formularies in the U.S. now providing access and around 15 other countries offering varying levels of reimbursement.”

In the United States, after measures to improve compliance level at the contract manufacturer site, Wegovy production resumed. In 2022, 150 inspections were conducted, compared to 97 in 2021. By year-end, 113 inspections were passed and 37 were unresolved. Follow-up on unresolved inspections continued in 2023.

Late in September 2023, Reuters reported that the FDA found quality control lapses at Novo Nordisk’s main factory in North America as early as May last year. The FDA inspection was at the company’s facility in Clayton, North Carolina, which produces semaglutide.

According to the news report, quoting Bloomberg News, the site makes oral semaglutide for Novo’s diabetes drug Rybelsus. The FDA report did not indicate there was any impact on users of Wegovy or Ozempic. However, the same issues, which were with the factory’s control systems to prevent microbial contamination, were raised in a more recent inspection in July 2023, the news outlet reported.

According to Reuters, the report from the May 2022 inspection shows that FDA officials found the factory had failed to include one type of bacteria, abbreviated as B. cepacia, on its list of “objectionable organisms.”

The news agency says according to the FDA’s report, two of the factory’s laboratory investigations, in 2020 and 2021, found drug product samples containing this particular bacteria.

To meet the more immediate demands for Wegovy and Ozempic, as well as for second-generation GLP-1 inhibitors still in clinical trials, Novo Nordisk has been making deals with contract manufacturers of injection devices.

In September, Ypsomed, a Swiss manufacturer of injectable delivery systems, announced that it concluded a long-term supply agreement with Novo Nordisk for large quantities of autoinjectors for the second-generation GLP-1 inhibitors. The company says it will deliver variants of the YpsoMate 1-ml autoinjector for various drugs in large quantities and will expand manufacturing capacities over the coming years. Additionally, Novo Nordisk is contributing a “significant” part of the investment for the new additional production infrastructure. These autoinjectors will be available for Novo Nordisk in 2025.

Reuters also reported in September that Novo Nordisk has hired U.S. private contract manufacturer PCI Pharma Services to handle assembly and packaging of Wegovy. The news service, quoting a confidential source, says the Philadelphia-based PCI, which has 15 facilities in North America, Europe, and Australia, is putting together the self-injection pens used to administer Wegovy.

In September, the United Kingdom became the fifth market for Wegovy, despite news reports that Novo Nordisk is still struggling to keep up with demand. Wegovy was initially launched in the United States in 2021, and has since been released in Denmark and Norway in early 2o23; and Germany in July.

A computer graphic of an administration building in Clayton, North Carolina for future facilities that will produce active pharmaceutical ingredients (API) for Novo Nordisk’s oral semaglutide, as well as some current and future GLP-1 and insulin products.

Novo Nordisk is confident that the company will be able to get past the manufacturing difficulties for Wegovy and continue with new product innovations. In April, executives announced that the company was raising its full-year sales and operating profit outlook. The company expects sales growth of 24 percent to 30 percent, and operating profit growth of 28 percent to 24 percent.

According to company executives, the outlook was raised primarily reflecting Wegovy prescription trends in the first quarter and higher full-year expectations for sales of Wegovy in the United States.

“Furthermore, a second contract manufacturer is now ready to begin production, thereby increasing Wegovy supply capacity,” executives stated.

The updated sales outlook also reflects higher full-year expectations for Ozempic sales, mainly in the United States, following accelerated volume growth of the GLP-1 class, executives say.

The company continues to release positive clinical news for Wegovy and its other semaglutide drugs.

In May, Novo Nordisk announced that results from OASIS 1, a Phase IIIa trial in the global OASIS program, showed that 50 mg oral semaglutide showed weight-loss results comparable to Wegovy, which is an injectable.

The efficacy and safety trial is comparing once-daily oral semaglutide 50 mg for weight management to placebo in 667 adults with obesity or overweight with one or more comorbidities. Executives say the trial achieved its primary endpoint by demonstrating a statistically significant and superior weight loss at week 68. People treated with oral semaglutide 50 mg achieved a statistically significant weight loss of 17.4 percent after 68 weeks compared to a 1.8 percent reduction with placebo. In addition, 89.2 percent of those who received oral semaglutide 50 mg, reached a weight loss of 5 percent or more after 68 weeks, compared to 24.5 percent with placebo.

“We are very pleased with the weight loss demonstrated by the once-daily oral formulation of semaglutide in obesity,” says Martin Holst Lange, executive VP for development at Novo Nordisk. “The results show comparable weight loss as in the STEP 1 trial with injectable semaglutide 2.4 mg in obesity branded as Wegovy. The choice between a daily tablet or weekly injection for obesity has the potential to offer patients and healthcare providers the opportunity to choose what best suits individual treatment preferences.” Novo Nordisk plans to file for regulatory approval in the United States and the European Union in 2023.

In March, the company announced that once-daily oral semaglutide 25 mg and 50 mg demonstrated a statistically significant and superior reduction in HbA1c at week 52 versus a 14 mg dose of oral semaglutide taken with other antidiabetes medications.

The PIONEER PLUS trial was a Phase IIIb, 68-week, efficacy and safety trial with once-daily oral semaglutide 25 mg and 50 mg versus 14 mg as add-on to a stable dose of 1–3 oral antidiabetic medicines in people with type 2 diabetes in need of treatment intensification.

People treated with 25 mg and 50 mg oral semaglutide achieved a statistically significant higher HbA1c reduction of 1.9 percentage points and 2.2 percentage points, respectively, compared with a reduction of 1.5 percentage points with oral semaglutide 14 mg. People treated with these doses of oral semaglutide experienced a statistically significant higher weight loss of 7.0 kg and 9.2 kg, respectively, compared with a reduction of 4.5 kg with oral semaglutide 14 mg.

Lange says the results showing the higher efficacy from the 25 mg and 50 mg doses provides physicians an option to progress patients to higher doses if additional glycemic control or weight loss are needed. Novo Nordisk expects to file for regulatory approvals for these doses in the United States and the European Union in 2023.

A study published in the New England Journal of Medicine in August demonstrated that people with obesity who have the most common form of heart failure also benefit from Wegovy.

The SELECT cardiovascular outcomes trial compared subcutaneous once-weekly semaglutide 2.4 mg with placebo as an adjunct to standard of care for prevention of major adverse cardiovascular events (MACEs) over a period of up to five years.

Executives say the trial achieved its primary objective by demonstrating a statistically significant and superior reduction in MACE of 20 percent for people treated with semaglutide 2.4 mg compared to placebo. The primary endpoint of the study was defined as the composite outcome of the first occurrence of MACE defined as cardiovascular death, non-fatal myocardial infarction, or non-fatal stroke. All three components of the primary endpoint contributed to the superior MACE reduction demonstrated by semaglutide 2.4 mg.

“People living with obesity have an increased risk of cardiovascular disease but to date, there are no approved weight management medications proven to deliver effective weight management while also reducing the risk of heart attack, stroke, or cardiovascular death,” Lange says. “Therefore, we are very excited about the results from SELECT showing that semaglutide 2.4 mg reduces the risk of cardiovascular events.”

The company expects to file for regulatory approvals of a label indication expansion for Wegovy 2.4 mg in the United States and the European Union in 2023.

Financial & product performance

In 2o22, Novo Nordisk recorded sales of DKK 176.95 billion ($24.99 billion), an increase of 25.7 percent from 2021. Of these sales, DKK 156.14 billion ($22.1 billion) derived from the company’s diabetes care sector, and DKK 20.54 billion ($2.9 billion) from rare disease products.

Net profit was DKK 55.52 billion ($7.84 billion), an increase of 16.3 percent. Diluted earnings per share were DKK 24.44 ($3.45) versus DKK 20.74 ($2.55).

In the first half of 2023, sales were DKK 107.67 billion ($15.21 billion), an increase of 29 percent compared with the same period last year. Net income was DKK 39.24 billion ($5.54 billion), 43 percent more than in first-half 2022. Diluted earnings per share were DKK 17.41 ($2.46), 44 percent higher than the same period last year.

Ozempic has charged to the lead of Novo Nordisk’s products, making $8.44 billion last year and set to surpass that number in 2023.

The company had 10 drugs that made more than $500 million each in 2022. Novo Nordisk’s leading product in sales, in 2022 and the first half of 2023, is Ozempic, The company recorded sales of DKK 59.57 billion ($8.44 billion) compared with DKK 33.71 billion ($4.76 billion) in 2021. First-half 2023 sales were DKK 41.74 billion ($5.9 billion) compared with DKK 26.38 billion ($4.6 billion) during the same period last year.

At No. 2 was the fast-acting insulin NovoRapid, which recorded sales of DKK 15.46 billion ($2.21 billion), 3 percent less than in 2021. First-half 2023 sales were DKK 7.03 billion ($994 million), 8.8 percent less than in first-half 2021.

Victoza (liraglutide), one of Novo Nordisk’s GLP-1 agonists, was the next best seller, recording sales of DKK 12.32 billion ($1.74 billion), a drop of 18 percent. First-half 2023 sales were also lower than those in the same period last year, going down 23 percent to DKK 4.65 billion ($657 million).

The oral semaglutide product Rybelsus generated 2022 sales of DKK 11.3 billion ($1.6 billion), compared with DKK 4.84 billion ($683 million) in 2021. Sales in the first half of this year continued strongly, at DKK 8.34 billion ($1.18 billion) compared with DKK 4.24 billion ($598 million) in the first six months of 2021.

The weight loss drug Saxenda, another formulation of liraglutide had a large increase in 2022 sales, rising to DKK 10.68 billion ($1.51 billion) from 2021’s DKK 7.01 billion ($991 million). During first-half 2023, sales were DKK 6.07 billion ($857 million), 36 percent more than in the same period last year.

Coming in at No. 6 in 2022 sales was the long-acting insulin Tresiba, at DKK 9.35 billion ($1.32 billion), a decrease of 3.9 percent compared with the year previous. Sales in the first half of 2023 continued to decline by 18.8 percent to DKK 3.93 billion ($555 million).

Holding the rank as the company’s seventh highest selling product in 2022 is the hemophilia drug NovoSeven, at DKK 8.31 billion ($1.17 billion), 15 percent more than in the previous year. First-half 2023 sales were DKK 3.9 billion ($550 million).

At No. 8 is the premixed insulin NovoMix, which had sales in 2022 of DKK 7.67 billion ($1.01 billion), 19 percent less than in 2021. Sales in the first half of 2023 were DKK 3.28 billion ($462 million), 21.3 percent less than in the same period last year.

The ninth drug with more than $500 million in 2022 sales was Wegovy, which shot up from DKK 6.19 billion ($874 million) from DKK 1.39 billion ($196 million). Sales continued to grow in first-half 2023, to DKK 12.08 billion ($1.71 billion) compared with DKK 2.59 billion ($366 million) in the first half of 2022.

The last among the company’s top 10 drugs in 2022 sales is the long-acting insulin Levemir, which generated DKK 4.58 billion ($646 million) 19.4 percent less than in 2021. Sales in first-half 2023 were DKK 1.93 billion ($272 million), 27.6 percent less than in the same half last year.

Collaborations for the future

Even as the success of semaglutide continues to surge, Novo Nordisk is looking ahead to figure out new ways to advance its leadership position in the diabetes and obesity care space, by making acquisitions and entering into collaborations.

In August, Novo Nordisk announced that it would be acquiring Inversago Pharma for up to $1.08 billion. Inversago Pharma is a private, Montreal-based developer of CB1 receptor-based therapies for the potential treatment of obesity, diabetes, and complications associated with metabolic disorders.

The acquisition of Inversago includes the company’s lead development asset, INV-202, an oral CB1 inverse agonist designed to preferentially block the receptor protein CB1. This plays an important role in metabolism and appetite regulation, in peripheral tissues such as adipose tissues, the gastrointestinal tract, the kidneys, liver, pancreas, muscles, and lungs. INV-202 demonstrated weight loss potential in a Phase Ib trial and is in a Phase II trial for diabetic kidney disease (DKD). Additional pipeline assets are also being developed for metabolic and fibrotic disorders. Novo Nordisk intends to investigate the potential of INV-202 for obesity and obesity-related complications.

“The acquisition of Inversago Pharma will further strengthen our clinical development pipeline in obesity and related disorders,” Lange stated. “This promising class of medicine pioneered by the Inversago team could lead to life-changing new treatment options for those living with a serious chronic disease and, in particular, may offer alternative or complementary solutions for people living with obesity.”

Inversago employs 22 people, who will continue to focus on the successful completion of the ongoing and planned trials, while working closely with Novo Nordisk to drive Inversago’s technology forward in future clinical trials. The acquisition is expected to close before the end of 2023.

The company in June entered into exclusive negotiations with BIO JAG, BIOCORP’s main shareholder, for the purchase of its entire stake in BIOCORP, representing 45.3 percent of its share capital and 62.2 percent of its theoretical voting rights, at a price of €35 per share.

Additionally, minority shareholders representing 19 percent of the share capital and 13.07 percent of the theoretical voting rights of BIOCORP, have committed to transfer shares to Novo Nordisk upon completion of the acquisition of BIO JAG’s stake. The proposed transaction would be followed by a mandatory simplified tender offer launched by Novo Nordisk on all remaining outstanding BIOCORP securities and, if the legal requirements are met, a mandatory squeeze-out of the remaining shareholders and de-listing of BIOCORP. BIOCORP is a French company specializing in the design, development, and manufacturing of delivery systems and innovative medical devices, including Mallya, a Bluetooth-enabled smart add-on device for pen injectors.

Since 2021 the companies have been collaborating on the development and commercialization of a Mallya add-on device for the Novo Nordisk FlexTouch pen used by people with diabetes, and during 2022 and 2023 this engagement has been expanded to the development of versions of the Mallya device for other therapeutic areas.

“Novo Nordisk has strong and established core capabilities within developing, scaling, and large-scale manufacturing of innovative injection devices for insulin and other medicines, and we are looking to increase agility to enable faster innovation and development of novel connected devices,” stated Marianne Ølholm, senior VP, Devices and Delivery Solutions at Novo Nordisk. “We have enjoyed a fruitful collaboration with BIOCORP over the past couple of years, and we hope to be able to welcome the company and its highly skilled workers into Novo Nordisk to complement our in-house efforts within connected delivery solutions and accelerate our ambitions within devices and delivery solutions.”

Executives say following the acquisition, Novo Nordisk would aim to preserve the agility and entrepreneurial spirit of BIOCORP, while investing further in the organization with the goal of delivering cutting-edge devices and delivery solutions to improve care for people across the globe living with serious chronic diseases.

Digging into the development of therapies for rare diseases, in May Novo Nordisk entered a research and development collaboration with Life Edit Therapeutics Inc., an ElevateBio company focused on next-generation gene editing technologies and therapeutics. The collaboration is focused on discovering and developing gene editing therapies against a select set of therapeutic targets.

Novo Nordisk will leverage Life Edit’s suite of gene editing technologies to precisely edit the genome with the aim of developing life-changing therapies for rare genetic disorders as well as more prevalent cardiometabolic diseases.

“At Novo Nordisk, we are committed to continuously building and leveraging technology platforms that open up new opportunities across our therapeutic areas to deliver potentially curative treatment options to people living with serious chronic diseases,” said Marcus Schindler, PhD, professor, executive VP and chief scientific officer of Novo Nordisk. “We are excited about the opportunity to co-create novel treatments for multiple genetic diseases based on Life Edit’s gene editing technologies.”

Base editing is a method of gene editing that converts one nucleotide base (a structural component of DNA) into another without cutting both strands of DNA. This is achieved by coupling an enzyme known as a nuclease, modified to cut only one DNA strand, to another enzyme known as a deaminase that edits the target nucleotide base. This precision is intended to reduce the risk of off-target effects and makes base editing a potentially effective approach for correcting genetic mutations associated with diseases.

The collaboration between the two companies allows for development of up to seven programs. Under the agreement, Life Edit will receive an upfront cash payment and is eligible to receive potential development, regulatory, and commercial milestones of $335 million for each of the first two development programs under the collaboration and up to $250 million for each of the following five development programs under the collaboration. Novo Nordisk will be responsible for all research and development costs and Life Edit is also eligible to receive tiered royalties on future net sales of therapeutic products. In addition, Life Edit has an option to a global profit share on one program.

In April, Novo Nordisk and Aspect Biosystems entered a partnership to develop bioprinted tissue therapeutics with the aim of delivering a new class of truly disease-modifying treatments for diabetes and obesity.

The collaboration will leverage Aspect’s proprietary bioprinting technology and Novo Nordisk’s expertise and technology in stem cell differentiation and cell therapy development and manufacturing. Novo Nordisk has developed expertise to differentiate stem cells into a wide array of cells that may be used to replace damaged and lost cells that could lead to a specific disease, such as insulin-producing beta cells in type 1 diabetes, as well as manufacturing capabilities to produce the cells at scale.

The goal of the collaboration is to develop implantable bioprinted tissues to replace, repair, or supplement biological functions.

The collaboration will initially focus on developing bioprinted tissue therapeutics designed to maintain normal blood glucose levels without the need for immunosuppression, which may represent a transformative treatment for people living with type 1 diabetes.

“Novo Nordisk has built strong capabilities when it comes to producing functional and highly pure therapeutic replacement cells at the highest quality and at scale,” says Jacob Sten Petersen, corporate VP of Cell Therapy R&D, Novo Nordisk. “Collaborating with Aspect Biosystems adds an important component to our strategy to develop comprehensive cell therapy products. We are excited to co-develop solutions for cell therapy delivery that could lead to life-changing treatments for those living with a serious chronic disease.”

Under the terms of the agreement, Novo Nordisk will receive an exclusive, worldwide license to use Aspect’s bioprinting technology to develop up to four products for the treatment of diabetes and/or obesity.

In return, Aspect will receive initial payments of $75 million, including an upfront payment, research funding, and an investment in the form of a convertible note.

Aspect is also eligible to receive up to $650 million in future development, regulatory, commercial, and sales milestone payments per product, as well as tiered royalties on future product sales.

![shutterstock_1959561142 [Converted] patient voice](https://www.pharmalive.com/wp-content/uploads/2023/11/amplify-voice-180x180.jpg)